Pension Funds as a Catalyst for Nature-based Investing

Natural capital is no longer just a buzzword; it has become a critical element of economic and environmental resilience. More and more, it is being recognised as an asset in its own right, and as climate change increases the intensity of natural disasters, the link between the worlds of natural capital and economic stability is becoming ever clearer.

Pension funds, with their long-term investment horizons and fiduciary duty to protect member returns, are uniquely positioned to deploy capital effectively to help ensure a transition to more sustainable investing. In doing so, the benefit is two-fold: sustainable investing leads to a more developed “green economy”, while also helping to offset the risk that climate change poses to the rest of the investment portfolio.

In this, the 5th episode of the Rebalance Earth podcast, we sit down with Darren Ward, Head of Alternatives, and Leandros Kalisperas, Chief Investment Officer at the West Yorkshire Pension Fund (WYPF), to discuss how they're pioneering investments in natural capital and shifting awareness towards understanding nature as business-critical infrastructure. It was a great chance to see behind the scenes of pension fund investment decisions and find out how their unique approach put them in a position to provide Rebalance Earth with its seed capital in a groundbreaking venture-style investment move.

The Power Of Pension Funds

Pension funds manage trillions of pounds worth of investments, and are in an ideal position to act as catalysts for investing in Natural capital for several reasons:

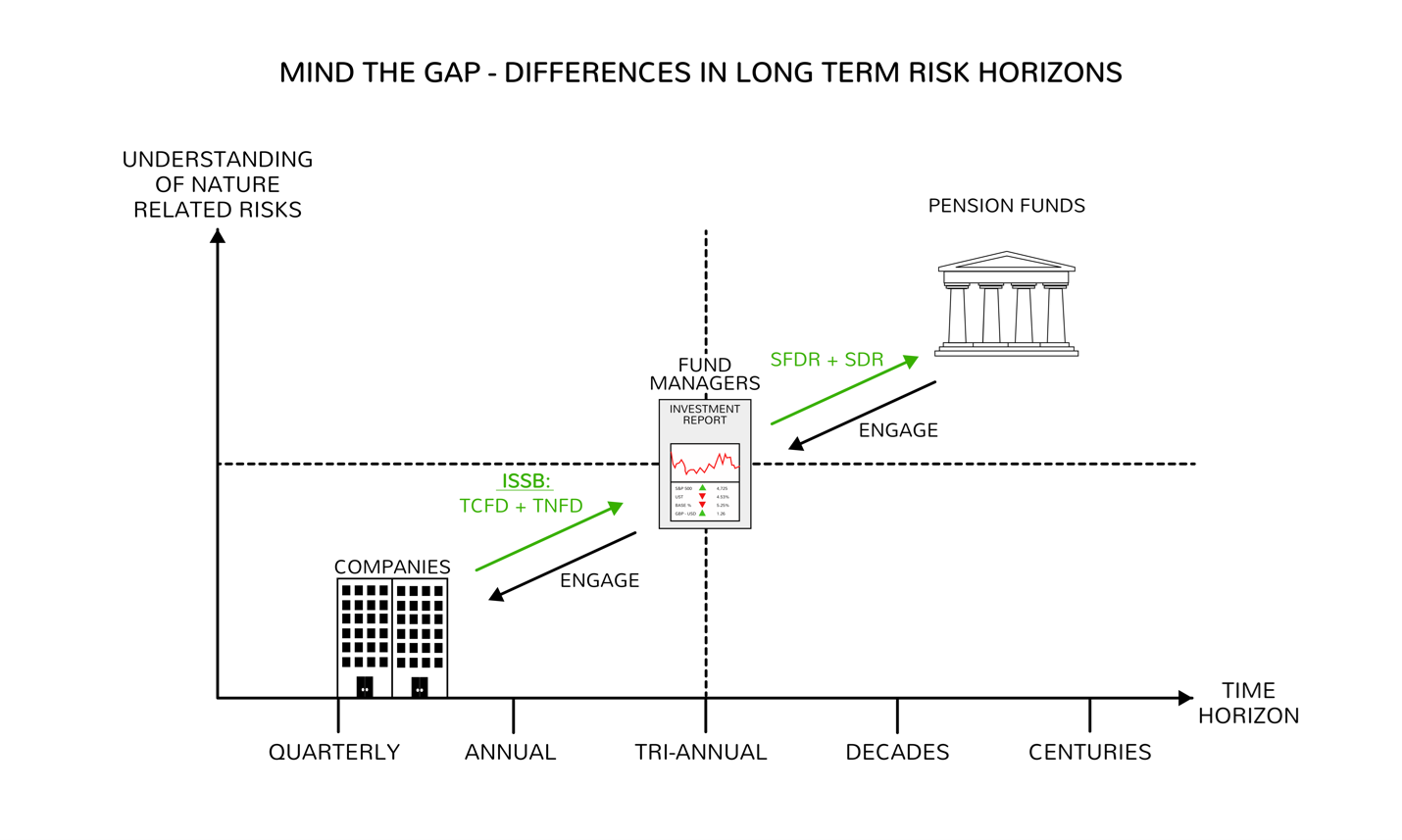

Long-Term Horizons: Unlike other investment funds, pension funds often operate with investment timelines spanning decades (the average career is about 38 years). This means that pension funds are deeply conscious of longer-term risks to their investment portfolio that other, more short-term focused funds may not be focused on.

A graphic to show how pension funds have much longer investment horizons than traditional fund managers, and shows how they exert influence over funds and consequently companies in aligning with sustainability regulations.

Stewardship Responsibilities: As fiduciaries for millions of beneficiaries, pension funds are tasked with ensuring not only financial returns but also the broader sustainability of the systems that underpin these returns. Natural capital directly supports economic stability by reducing risks such as climate change and biodiversity loss, which could have negative impacts on the rest of the portfolio (something that new legislation is forcing them to investigate in more detail)

Scale and Influence: With significant capital at their disposal, pension funds can drive market transformations by setting examples, influencing policy, and encouraging innovation in underfunded sectors.

Diversification Needs: Nature-based solutions often provide uncorrelated returns, making them an attractive addition to diversified portfolios. Nature-based investments operate outside of the typical boom-bust economic cycles, adding stability to a well-diversified portfolio.

Direct and Patient Capital

Pension funds are unique outliers in terms of their investing time-horizons because unlike other funds, there isn’t a similar pressure to work towards quarterly and yearly targets. This allows them to make investments in projects that might not create returns for lengths of time that would be unthinkable to other types of investment funds.

Leandros summarised this well in this document when he said “As a large asset owner with a long-term horizon, we have a responsibility to provide direct patient capital to Nature as infrastructure and to start to address critical issues like climate change adaptation and resilience here in the UK."

The “direct” component of investments in Natural Capital is essential for the UK, which is currently one of the most nature-depleted countries on the planet, having lost about 20% of its biodiversity since 1970, and over 50% since the start of the industrial revolution. Restoring our Natural Capital is essential to improve our to climate change, which will continue to bring adverse climate conditions affecting both communities and companies.

According to the World Economic Forum, more than half of global GDP is moderately or highly dependent on nature. Despite this, natural capital has historically been undervalued in financial markets, leading to its overexploitation and degradation.

However, the narrative is shifting. Institutions like pension funds are beginning to recognise the need to invest in natural capital not just as a moral imperative but as an economic opportunity. Nature-based solutions, such as river restoration, urban green infrastructure, and regenerative agriculture, offer tangible returns alongside substantial environmental and social benefits.

Adapting to Changing Regulations

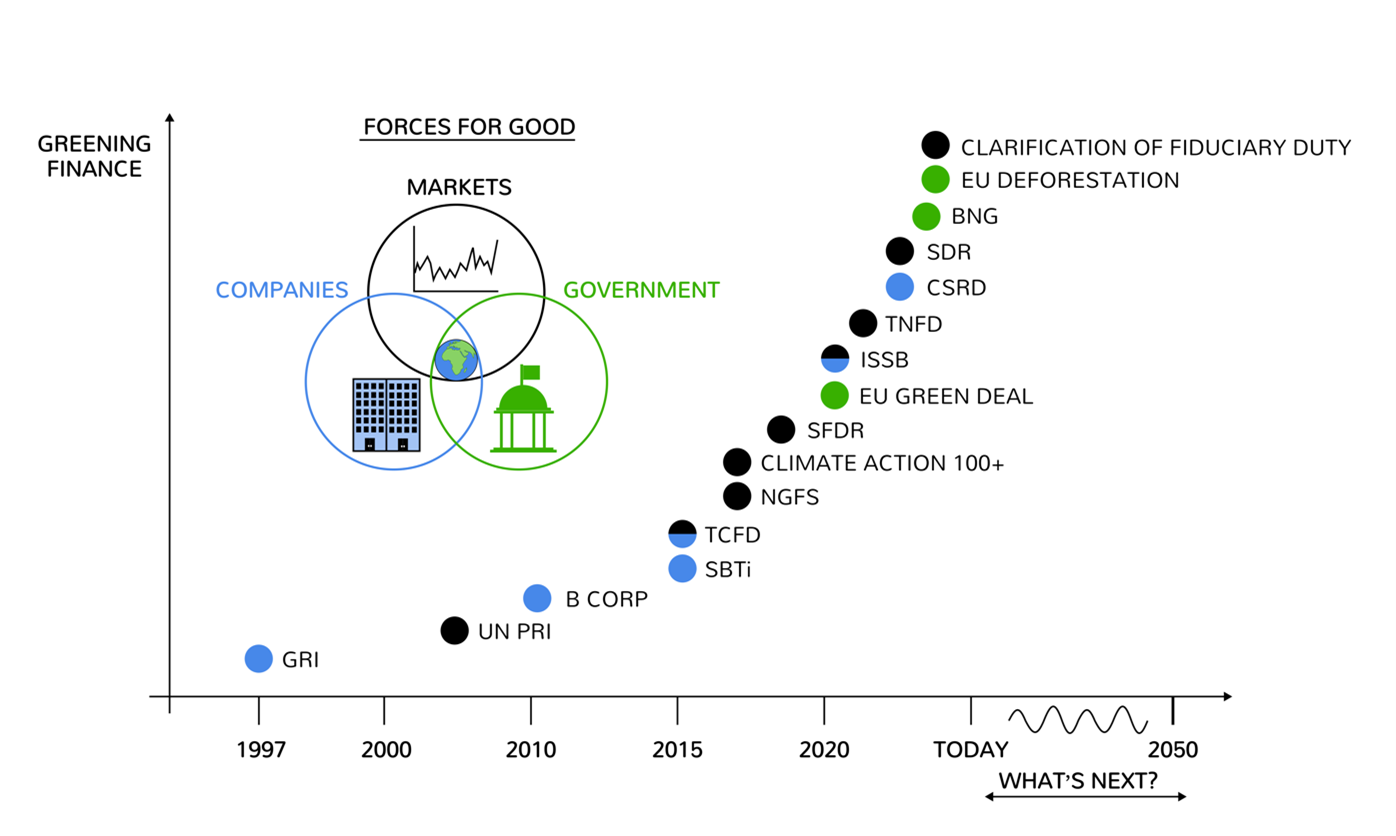

The regulatory environment for pension funds is rapidly changing, particularly in the UK, where initiatives are shaping how funds account for sustainability. These frameworks encourage transparency in assessing and managing climate- and nature-related risks.

TCFD: Introduced in 2015, this framework helps institutions disclose climate-related risks and opportunities. UK pension funds must now report under TCFD guidelines, enhancing transparency and accountability.

TNFD: Building on TCFD, TNFD focuses on nature-related risks, aiming to standardize assessments of biodiversity and ecosystem dependencies.

A timeline demonstrating the increasing rate of sustainable investing legislation. Black represents market regulation, blue for companies and green for government regulation.

By embracing these frameworks, pension funds can align with global best practices while ensuring compliance with domestic regulations. These initiatives also improve accountability, making it easier for pension members to understand the environmental impact of their pensions. It creates an incentive to invest in assets that have a net-positive effect, in order to balance other assets that are perhaps more exposed (for example, investing in local natural flood management reduces flood risk to the property investments in the same area)

This was one of the reasons that direct investment into Natural Capital was so attractive to WYPF, in that it allows the fund to take an active role in mitigating the systematic risk to the entire investment and economic landscape that climate change creates. As Leandros explained, “You can't change systematic risk. And that's something that natural capital is provocative to, because if as a society, if as economies, we have consumed too much of nature, then we are actually acting upon that systematic risk.” Investing in Natural Capital, therefore, can act as a hedge, working outside of economic cycles and helping to mitigate the risk to the rest of the portfolio that climate change implies.

A Vision for the Future

Both Darren and Leandros envision a future where natural capital becomes an integral asset class across all investment portfolios, moving beyond the edges of the investment space to become a fundamental pillar of any pension fund investment strategy.

Leandros articulated this aspiration: “Can West Yorkshire play a part in, in deepening the investment in replenishing nature within the UK? Can it play a small part in that? We hope so.”

In being a first mover through their seed funding investment into Rebalance Earth, they are paving the way for landscape level Nature restoration projects to come onto the UK investment scene. It’s a calculated risk that both Leandros and Darran feel will pay off, not just for WYPF, but for the Natural Capital markets of the UK as a whole. This is reinforced by a recent Morgan Stanley survey titled “Sustainable Signals” which found that “Four out of five asset managers and owners expect to see increases in their sustainable assets under management (AUM) and allocations over the next two years” [1]

By being an innovator in the space it also means that WYPF are able to attract some of the brightest new talent looking to work in asset management, with sustainable investing being seen as a non-negotiable among many of the younger generation. As Darren reflected, “Continuing that recruitment of those young stars, they're incredible. From our graduates to our analysts, to our deputies, all incredible, hardworking staff who just get it.”

Building a World Worth Living In

WYPF’s pioneering efforts underline the critical role of institutional investors in addressing global challenges. By treating nature as infrastructure and integrating natural capital into its portfolio, WYPF is not just investing in assets but in a sustainable, resilient future. Its pioneering investment in Rebalance Earth also drives improvements in scale and investibility of projects, benefiting the wider investment community as a whole by bringing more suitable projects to market.

Moreover, the WYPFs leadership sets a benchmark for others in the industry. By combining innovation, community engagement, and technological advancement, WYPF provides an example as to how pension funds can drive meaningful change. The journey may be complex, but the rewards—for both investors and the planet—are immeasurable.